Resources

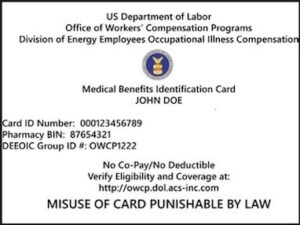

Receive assistance with submitting a claim for your white card under the EEOICPA

EEOICPA General Information from the Department of Labor. https://www.dol.gov/agencies/owcp/energy

Questions and answers about EEOICPA from the Department of Labor. https://www.dol.gov/agencies/owcp/energy/regs/compliance/brochure/brochures

EEOICPA list of general benefits under part B and part E from the Department of Labor. https://www.dol.gov/agencies/owcp/energy/regs/compliance/progbenefits

https://lni.wa.gov/for-workers

What is Long Term Care Insurance?

Long-term care (LTC) insurance, according to Washington state law (leg.wa.gov), is an insurance policy, contract or rider that provides coverage for at least 12 consecutive months to an insured person if they experience a debilitating prolonged illness or disability.

What does LTC insurance cover?

LTC insurance typically covers these services if they’re provided in a setting other than a hospital’s acute care unit:

- Diagnostic

- Preventive

- Therapeutic

- Rehabilitative

- Maintenance

- Personal care

LTC insurance typically pays benefits when an insured person can no longer independently do two or more of the following activities of daily living (ADLs):

- Bathe

- Go to the bathroom

- Eat

- Dress

- Transfer (such as getting out of a chair or bed)

- Control their bladder or bowels (continence)

Some life insurance and annuity policies include LTC insurance as a rider. However, some life insurance policy riders don’t qualify as long-term care insurance in our state according to RCW 48.83.020 (leg.wa.gov). See a list of companies approved to sell long-term care insurance in Washington state.

Learn more by visiting:

https://www.insurance.wa.gov/long-term-care-insurance

Consider the following private pay options when exploring how to cover home care costs:

- Annuities. These can be purchased from banks, mutual fund companies, and brokerage firms and funded through savings. After you purchase, the institution will issue payments to your loved one. As with any financial investment, be sure to work with a trusted company or advisor.

- Reverse mortgages. If your loved one owns a home, they can use a reverse mortgage to pay for long-term care at home. Scammers often target seniors in this area, so only work with a reputable institution.

- Collective sibling agreements. Sometimes children help pay for a parent’s care with the understanding that they’ll be reimbursed from their parent’s estate. It’s helpful to put this agreement in writing and share it with the executor of the will.